16+ Calculation Of Eva

Economic Value Added EVA is an estimate of true economic profit and a tool that focuses on maximizing shareholders wealth. Economic Value Added EVA is a financial performance method to calculate the true economic profit of a corporation.

Immc Swd 282020 29500 20final Eng Xhtml 2 En Autre Document Travail Service Part1 V6 Docx

K is the economic capital.

. Residual income is defined as a companys net. EVA serves as a measurement that. The formula for EVA is.

Calculation of EVA Putting the economic value added formula into practice an EVA calculation could look like the following. Total assets were 80000000 and noninterest-bearing current liabilities were 6700000. In principle depreciation should.

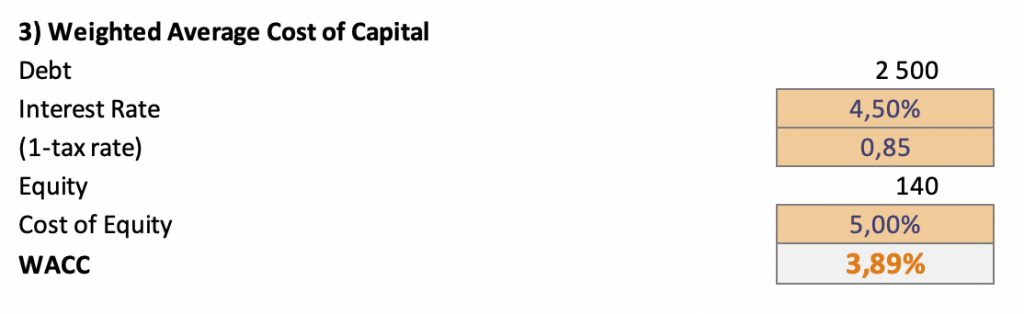

The EVA calculation is based on a companys residual income. EVA is based on the idea that a company must cover. You can calculate the finance charge once you have determined the WACC and the capital invested.

NOPAT Net operating profits. In effect EVA treats all leases as finance leases. A company has a net profit of 250000 after.

Economic Value Added EVA formula Net Operating Profit After Tax Capital Invested x WACC Here Capital Invested x WACC stands for the cost of capital. EVA can be calculated as net operating profit after tax minus a charge for the opportunity cost of the capital invested. The weighted average cost of capital or simply called WACC is the most suitable measure for calculating the rate of return of a business as it includes all types of capital used by the.

EVA adopts almost the same form as residual income and can be expressed as follows. EVA EBIT 1 Tax Rate WACC Invested Capital Invested Capital is the equity plus long-term debt at the outset of the period of interest. EVA can be calculated as Net Operating Profit After Tax minus a charge.

EVA NOPAT WACC capital invested Where. You must calculate EVA using two amounts and this is the second one. To calculate EVA you first need to calculate residual income.

Companies best utilize EVA as a comprehensive. Formula to calculate EVA r c K NOPAT c K Here r s the ROIC return on investment capital NOPAT is the net operating profit after tax. Any operating lease charges in the income statement should be added back and removed from NOPAT.

EVA formula Economic value added is calculated by deducting capital cost from the companys operating profit adjusted for taxes on a cash basis. The company s cost of capital required rate of return is 10 percentRequired.

Economic Value Added Eva Break Down And Calculation Magnimetrics

Breaking Down The Economic Value Added Eva Calculation By Dobromir Dikov Fcca Magnimetrics Medium

Thinkcar Thinkdiag 2 Support Can Fd Ecu Coding Active Test All Software 1 Year Free Update Launch Tool Com

Economic Value Added Formula Example How To Calculate Eva

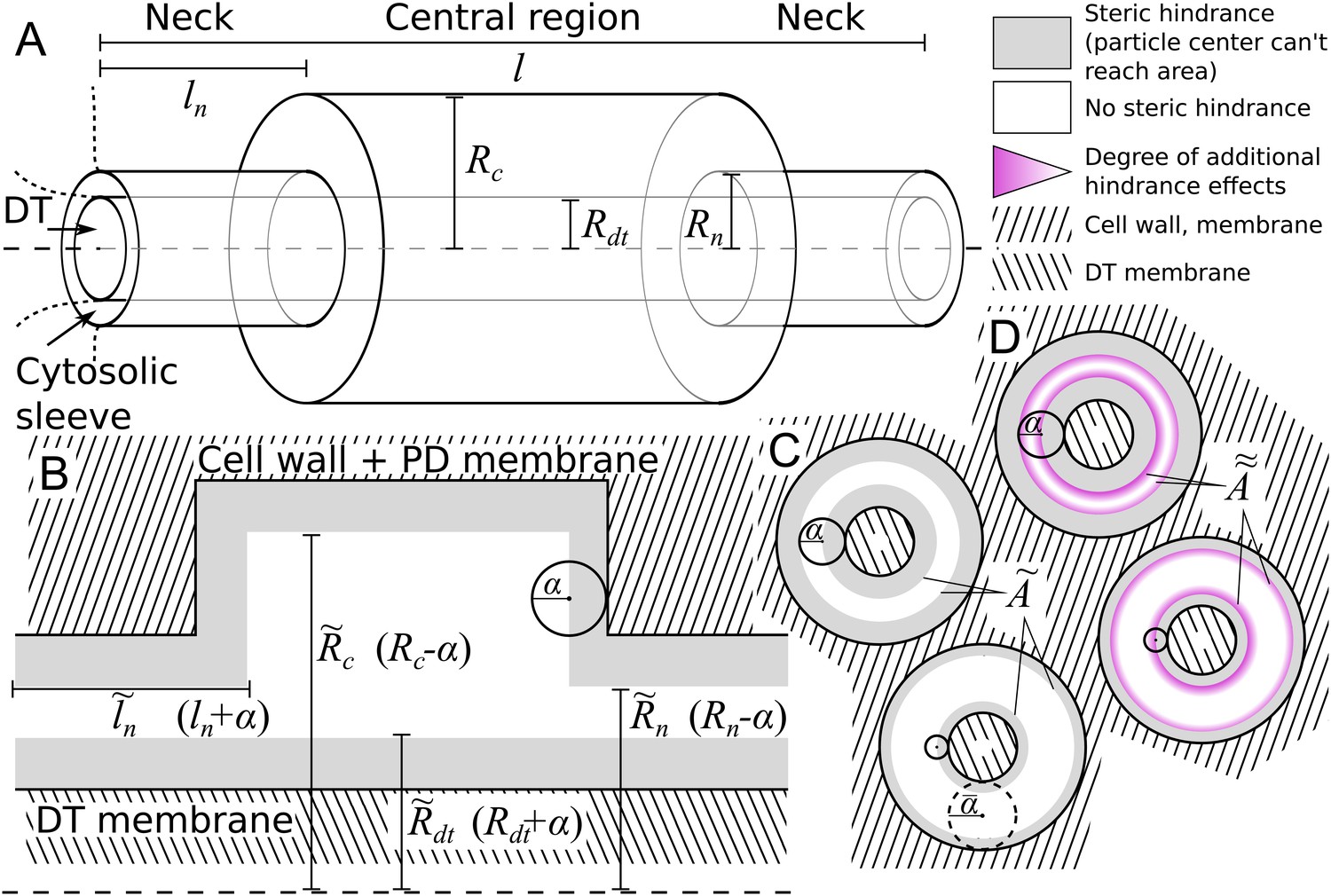

From Plasmodesma Geometry To Effective Symplasmic Permeability Through Biophysical Modelling Elife

What To Know About Economic Value Added Eva

The Energy Levels And Transitions Of Fe Xvi Fe And Fe Xvii Download Scientific Diagram

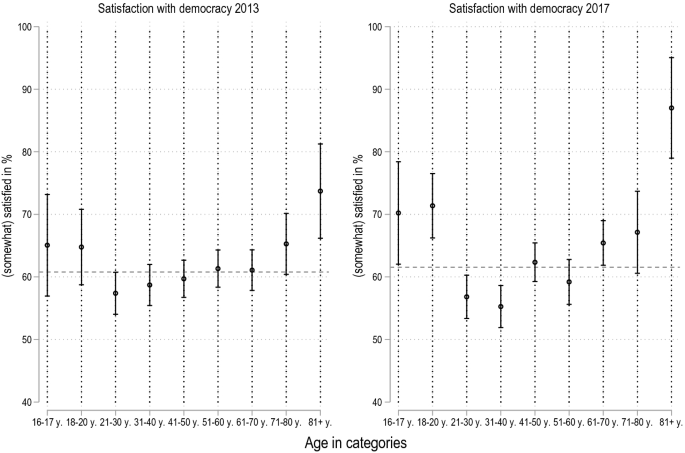

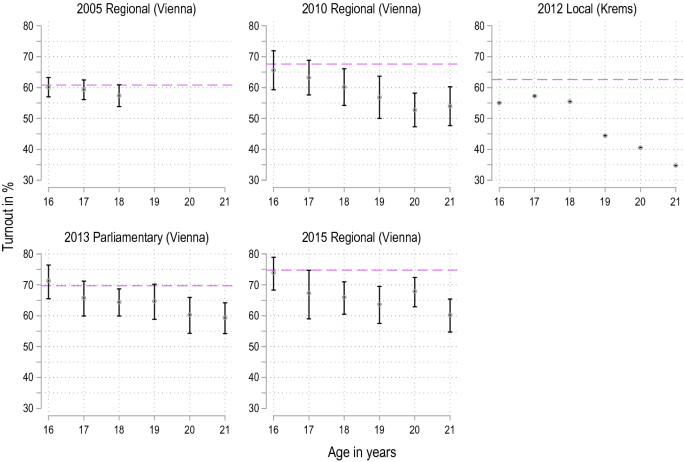

Voting At 16 In Practice A Review Of The Austrian Case Springerlink

Economic Value Added Eva Break Down And Calculation Magnimetrics

Molecular Dynamics Simulations On Gas Phase Proteins With Mobile Protons Inclusion Of All Atom Charge Solvation The Journal Of Physical Chemistry B

Divisional Performance Measurement Economic Value Added Acca Apm

Breaking Down The Economic Value Added Eva Calculation By Dobromir Dikov Fcca Magnimetrics Medium

Voting At 16 In Practice A Review Of The Austrian Case Springerlink

How To Calculate Economic Value Added Eva In 2022 Formula Example

1158 E Eva St Rentals Phoenix Az Rentcafe

Abstracts 2022 Haemophilia Wiley Online Library

The Energy Levels And Transitions Of Fe Xvi Fe 15 And Fe Xvii Fe Download Scientific Diagram